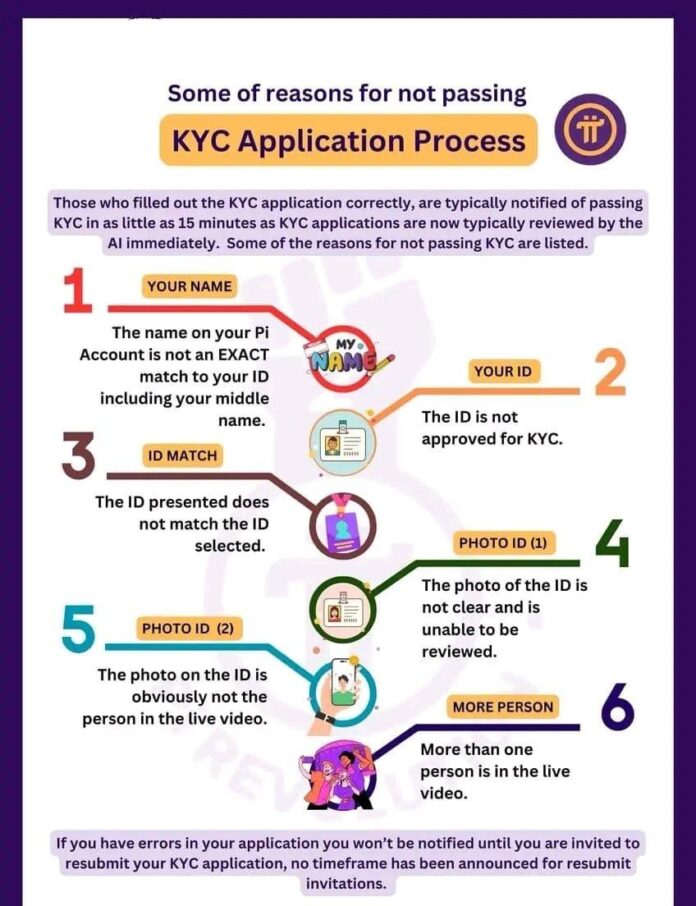

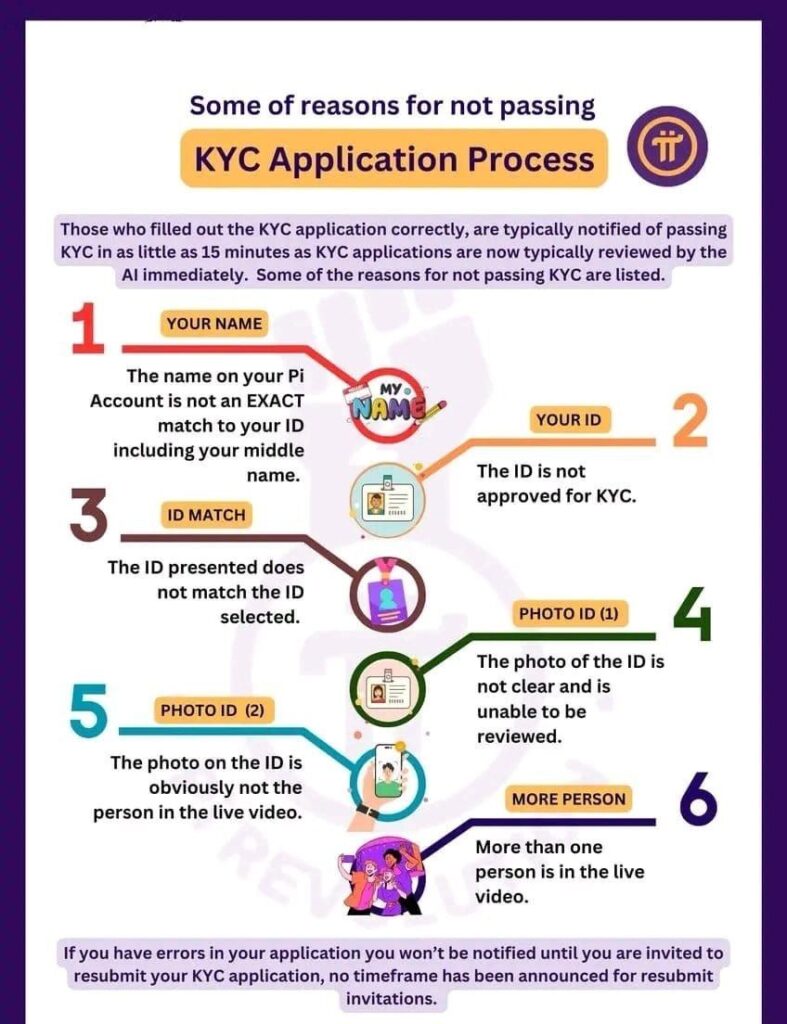

Embarking on the intricate journey within Pi Network, we unravel the complexities of the Know Your Customer (KYC) application process. This exploration sheds light on the reasons some individuals face hurdles in their pursuit of approval.

1. Your Name – Precision is Paramount:

Encountering a fundamental obstacle when the name on the Pi account lacks exact alignment with details on official identification, including the middle name. A precise match becomes pivotal for a seamless KYC approval process.

2. Your ID – Navigating the Approval Conundrum:

Facing a setback when the submitted ID falls short of securing approval for KYC. Meticulously adhering to specified guidelines is imperative for a hassle-free verification process.

3. ID Match – The Consistency Challenge:

Mismatch between the presented ID and the one selected during the application process raises red flags. Maintaining consistency in submitted information is paramount for a successful KYC verification.

4. Photo ID 1 – The Clarity Conundrum:

The clarity of documentation plays a pivotal role in the KYC process. If the photo of the ID is unclear and challenging to review, it becomes a roadblock in the application. Ensuring high-quality, readable images is essential for a smooth verification journey.

5. Photo ID 2 – The Visual Verification Vexation:

Encountering a common hurdle when the photo on the ID doesn’t correspond to the individual in the live video during the KYC process. Accuracy in visual identification is paramount to establishing the authenticity of the application.

6. More Than One Person – The Individuality Imperative:

Participating in the live video verification with more than one person can lead to rejection. The KYC process is designed for individual identification, and any deviation may result in complications.

It’s crucial to note that individuals may not receive immediate notifications about errors. Notifications occur when an invitation to resubmit the KYC application is extended. However, a specific timeframe for resubmission invitations has not been officially announced.

In essence, the KYC application process demands meticulous attention to detail, emphasizing the alignment of submitted information with provided guidelines. This exploration serves as a valuable guide for individuals navigating through the Pi Network KYC process, offering clarity on potential pitfalls and emphasizing the importance of precision in documentation. While challenges may arise, understanding the intricacies is the first step toward a successful KYC verification journey.

Read More – Pi Network Price In India.

New Mining App

Download & Start Mining on – Athene Network